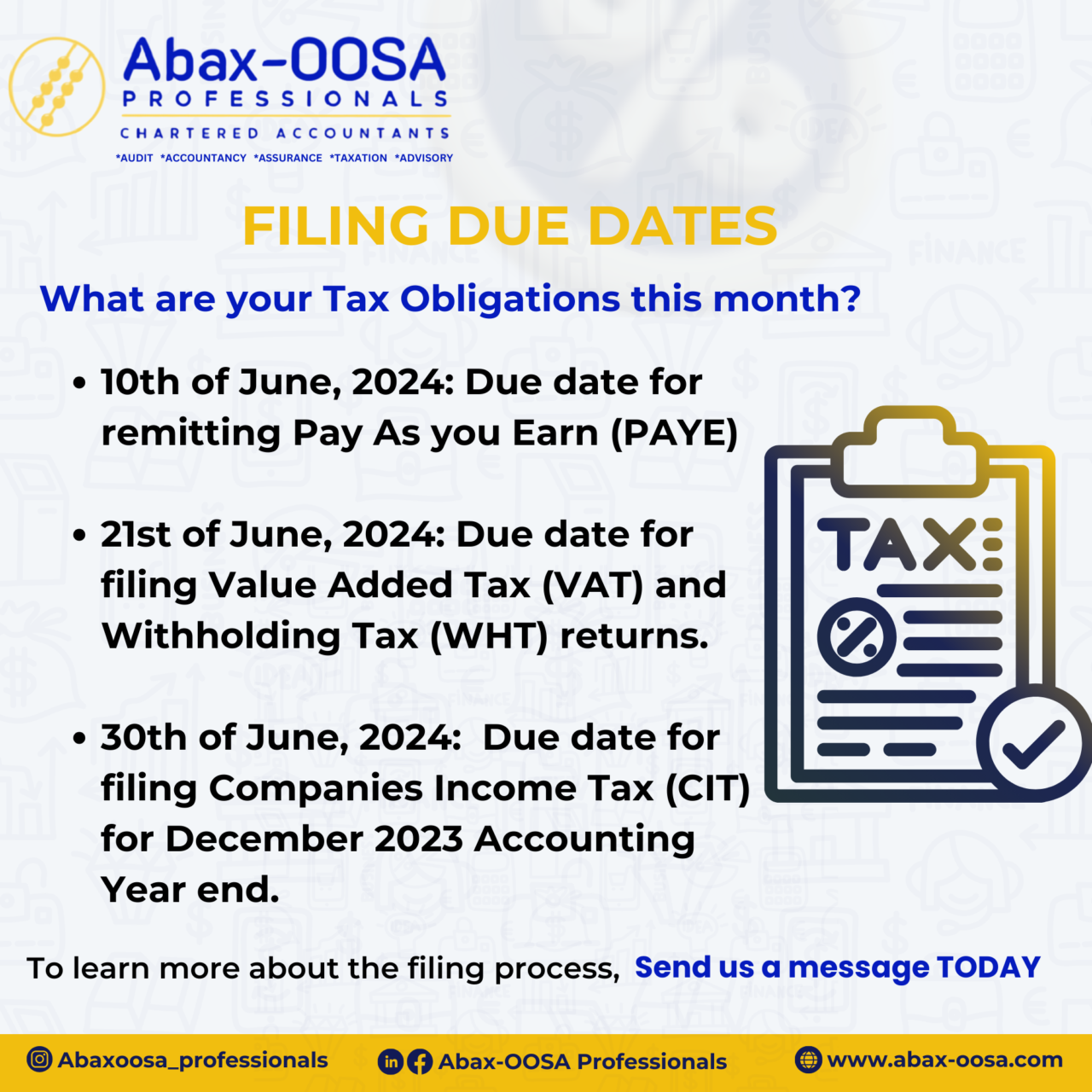

As we approach the end of the first half of 2024, it’s crucial to stay on top of your tax obligations to ensure compliance and avoid penalties. Here are the key due dates for this month:

- 10th of June 2024: Due date for remitting Pay As You Earn (PAYE).

- 21st of June 2024: Due date for filing Value Added Tax (VAT) and Withholding Tax (WHT) returns.

- 30th of June 2024: Due date for filing Companies Income Tax (CIT) for the December 2023 Accounting Year end.

Explanation of This Month’s Key Tax Obligations

Understanding your tax obligations is essential for effective financial management. Here’s a brief explanation of each tax type due this month:

- Pay As You Earn (PAYE): A tax deducted by employers from employees’ salaries or wages and remitted to the relevant tax authority.

- Value Added Tax (VAT): A consumption tax levied on the value added to goods and services at each stage of production or distribution. It is charged at a rate of 7.5% on the value of goods and services consumed by the end consumer.

- Withholding Tax (WHT): The specified amount deducted at source from payments made to individuals or corporate entities for services rendered or investment.

- Companies Income Tax (CIT): A tax imposed on the profits of companies based on their annual turnover. Companies with a turnover of ₦25 million or less are exempted. For those with a turnover greater than ₦25 million but not exceeding ₦100 million, the tax rate is 20%. For companies with a turnover exceeding ₦100 million, the tax rate is 30%.

- Tertiary Education Tax (TET): A tax levied on the assessable profit of all registered companies, requiring them to pay TET at a rate of 3% of their assessable profit. The funds are used to support tertiary education in the country.

Timely compliance with tax deadlines is crucial to avoid penalties and ensure smooth business operations. Click here to find the detailed attachments for easy reference.